-

Help America Save Again

#HASA

Are you a part of the solution or part of the problem?

The Three Legged Stool.

- Social Security - According to SSA.GOV, on average will replace about 40% of your annual pre-retirement earnings.

- Employer-Sponsored Pension - Traditional or Roth.

- Individual Savings and Investments - Click on the stool for JR's Wealth Strategy.

-

But What Is Grit?

From Wikipedia as (personality trait), "perseverance and passion for long-term goals."

Our Goal

Is to empower each individual to be financially responsible for their future. Practical Financial Wisdom. Individual goals differ from person to person and our job is to identify those goals.

-

Who We Are

We are financial professionals whose belief is always what is the best interest of our clients. We will search for the right product before making our recommendations or revisions.

-

Our Philosophy

We want to empower our clients using concepts of preservation of capital. We believe that this is one concept that will help secure their financial future.

Warren Buffet Rules of money are:

#1 Don't lose money.

#2 Don't forget rule #1. -

Our Process

Derived from one of the best known and credible financial school "The American College of Financial Services". (ChFC, FSCP, CLU, CFP, CLF, MSM, MSFS, PhD, etc.)

- Identifying prospects by using target marketing. We partnered with other financial institutions to get in front of people who needs our service. It is better to do business with prospects who are looking for our services.

- Only approaching prospects who successfully filled out some kind of form needing our services.

- Meeting prospects by setting an appointment. We don't want to waste anybody's time.

- Gathering information and establishing goals by making sure that our recommendations will be -Comfortable -Affordable -Sustainable -Qualified We will gather information to look for funding sources.

- Analyze all information using the following attributes:

-Needs Analysis

-Financial Risk Tolerance

-Risk Management Strategies and Concepts

-Risk Exposure

-Investment Management Concepts

- Developing and presenting the plan by finding and comparing the best use of illustrations. For most financial companies, this is a requirement before going on the application. We work with more than 20 financial companies and we will strategically find the best plan for you so you don't have to. We will prepare and show you the timelines for what is available as you reach certain age phases.

- Implementing the plan by assisting you all the way. We will coordinate with other financial professional for other needed services that will complement the services you are getting from us. Some examples are:

-Accountants

-Attorneys

-Real Estate Advisors

-Stock Brokers

- Servicing the plan by monitoring and evaluating the soundness of our recommendations. We will do this by Annual Review of your policies. This way, we can see the changes in our clients personal circumstances like:

-New births in the family. Add additional coverage. Show alternative savings plan like "The Millionaire Baby Plan"

-Deaths in the family. Change beneficiary or help in the process of getting the death benefit from the insurance companies.

-Illness. Show our clients their living benefits if apply.

-Divorce. Changing beneficiary to the right person.

-Change in Job Status. For flexible premiums, you can go up or down on your monthly's.We also look out for changes with the following before making any recommendations or revisions:

-Tax laws

-Benefit and Pension Options

-Economic Environment

-

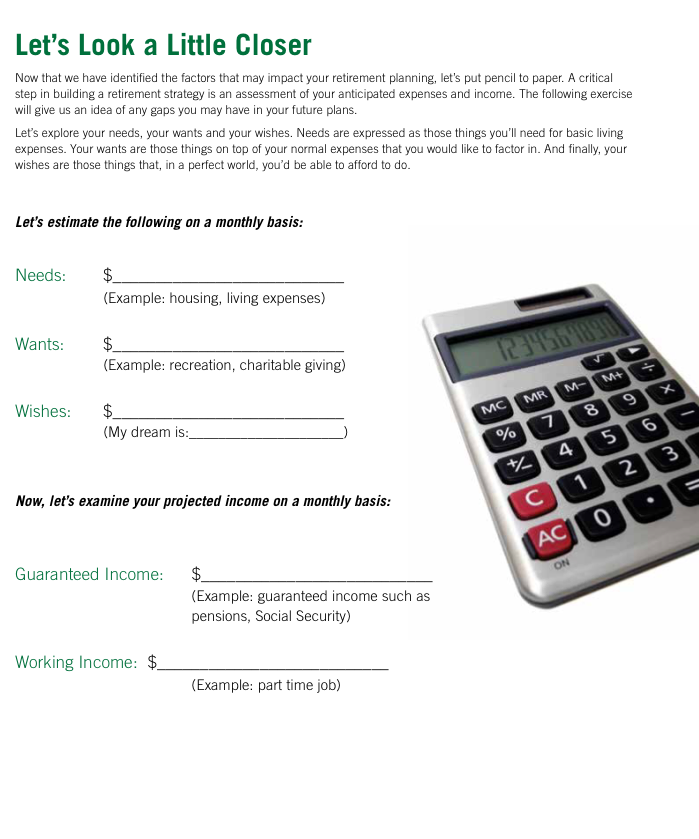

Bridge The Retirement Gap

-

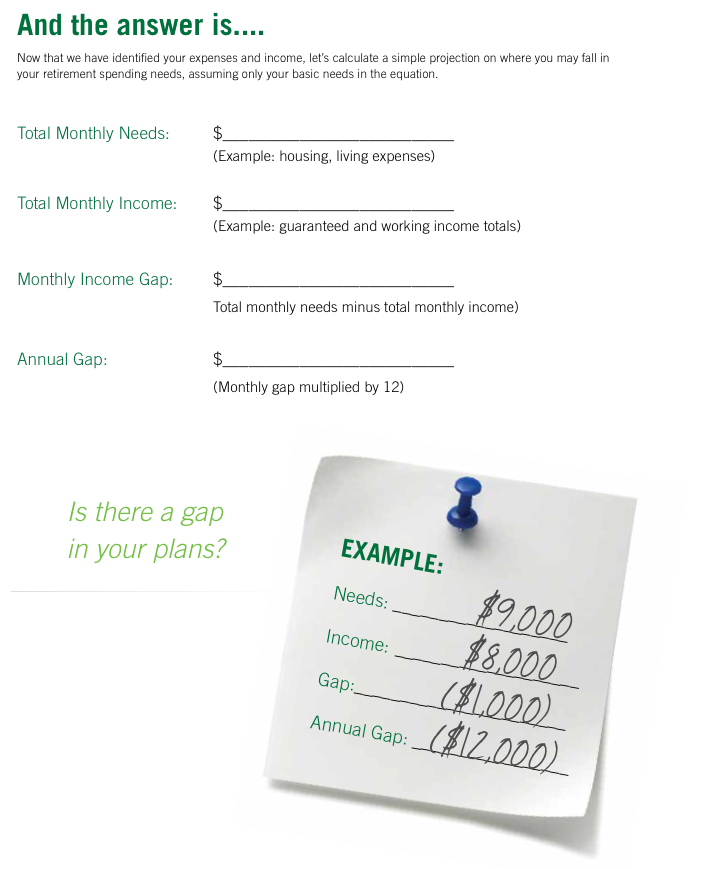

Financial Tools

Click Here to compare your Investment Accounts (IA)

Click Here to compare your Investment Accounts (IA)

-

Did you know?

You can't escape taxes forever...

Consumers lack insurance literacy by CNBC.

-

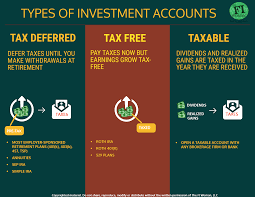

SEMCAST

Safe Equity Mortgage CAncellation STrategy

Read here for explanation of Harvest Strategy written by Investopedia. -

SAVE LESS IF YOU SAVE NOW

The EARLY you SAVE, the LESS you will have to SAVE.

VS.

If you WAIT to save, the MORE you will have to SAVE.Use this Save Now or Save Later calculator, courtesy of Securian.

CNBC have a good article about growing your wealth no matter what the economy is doing. Click here.

-

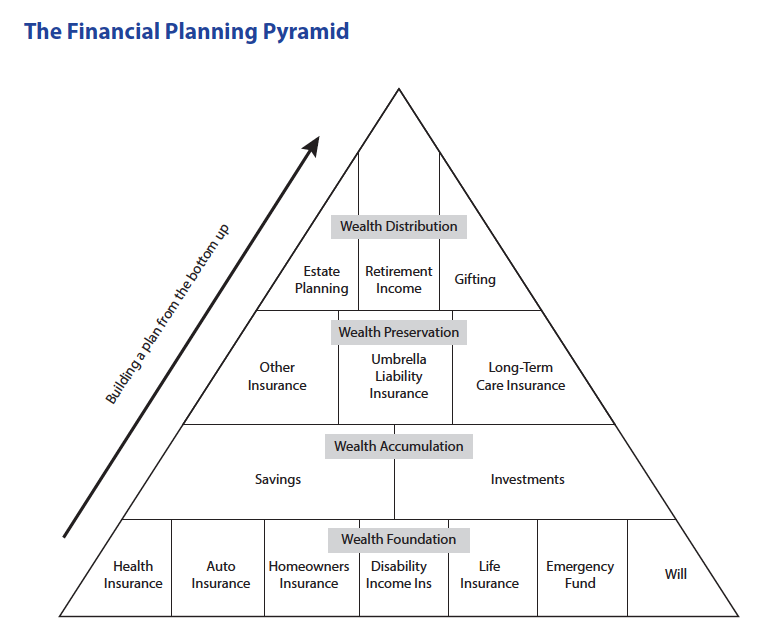

OUR SERVICES

Using the Financial Planning Pyramid concept.

Courtesy of The American College of Financial Services

- Tax Free Retirement Income

- using Variable Loans

- mostly used NAIC Recent Moody's Corporate Average Yields - Lifetime Income

- Leverage your life insurance accumulated cash value for lifetime retirement tax free income

- Here's 8 ways to Get Tax-Free Income by Forbes - Financial Education - Education that you never had in school

- - Credit Education - with FES

- Risk Management - using life insurance

- Life Insurance - 15+ carriers. We will use what's best for you

- Annuities - 15+ carriers. We will use what's best for you

- Indexed Universal Life - the power of lifetime tax free income

- - Indexed Account Mechanics

- Safe Equity Mortgage Cancellation Strategy Premium Financing

- For Homeowners

- Advance concept

- Not everybody qualifies

- Click here to learn about Harvest Strategy from Investopedia. - Risk Transfers - using life insurance

- Accelerated Benefit Riders for Long-Term Care needs:

- Terminal Illness

- Chronic Illness

- Critical Illness - Living Benefits - comes with different names:

- Accelerated Benefit Riders

- Accelerated Death Benefits

- Quality of Life - Credit Repair - with UCES

- Credit Attorney - with FES Protection Plan

- Proactive Identity Theft Protection - with Lifelock

- Build or Re-Build Credit. Fast approval - with First Progress Platinum MasterCard® Secured Credit Card

- Smart Credit Scores/Report Monitoring - with Smart Credit

- Affordable Estate Plan developed by lawyers:

- Last Will

- Living Trust

- Healthcare Power of Attorney

- Financial Power of Attorney - Debt Zero - with FES Protection Plan

- Mortgage Debt Elimination Calculation - using MDEC

- Financial Lockbox - with FES Protection Plan

- Ultra Score. Maximize your credit potential - with FES Protection Plan

- Budgeting - with Go Financial San Diego

- Kai-Zen Plan

- Used for High Executives that earns $100,000 or more per year

- Participants contributions are leverage 3:1. - Legal Protection - through LegalShield

- Teachers, take note of your retirement gap. See retirement homeroom.

- Pay for college without going broke. See 2023 edition by The Princeton Review. You can study the book or we can help you navigate for free. Schedule a call.

- Tax Free Retirement Income

-

FINANCIAL TOOLS

- 401k Retirement Calculator

www.bankrate.com/retirement/calculators/401-k-retirement-calculator/ - ANNUALCREDITREPORT.COM

- COLLEGE PLANNING SEARCH

www.collegescorecard.ed.gov

www.bigfuture.collegeboard.org/college-university-search/san-diego-state-university - EFFECTS OF INFLATION

usinflationcalculator.com/inflation/current-inflation-rates - FINRA RETIREMENT CALCULATOR

apps.finra.org/calcs/1/retirement - HOW MUCH DO YOU NEED TO RETIRE - Roth, Bankrate

www.bankrate.com/calculators/retirement/roth-ira-plan-calculator.aspx - MORTGAGE RATES

bankrate.com/mortgage.aspx - MUTUAL FUND FEES CALCULATOR

marketwatch.com/tools/mutual-fund/compare - NAIC Recent Moody's Corporate Average Yields

naic.org/research_moody.htm - RETIREMENT INCOME LITERACY SURVEY

retirement.theamericancollege.edu - SPEND DOWN CALCULATOR / ANNUITY

bankrate.com/calculators/investing/annuity-calculator.aspx - S&P 500 Historical return

pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/histretSP.html - Social Security Calculator

www.aarp.org/retirement/social-security/benefits-calculator/

- 401k Retirement Calculator

-

What's Better - Life Insurance or Annuities?

IUL Annuities Free from Market Risk1 Yes Yes Tax Deferred Accumulation2 Yes Yes Tax-Free Death Benefit3 Yes No Tax-Free Lifetime Distributions3 Yes No Living Benefits4 Yes No Income in excess of 6% of Cash Value5 Yes No Guaranteed Lifetime Income6 No Yes References:

1. Indexed Universal Life Insurance: How It Works. Investopedia

2. Understanding Taxes on Life Insurance Premiums. Investopedia

3. What Are the Benefits of IUL Insurance? Smart Asset

4. Five Living Benefits Available With IUL Products. Think Advisor

5. The basics of how IULs work. Indexed Account Mechanics

6. What is lifetime income? Teachers Insurance and Annuity Association of America (TIAA)

Bridging The Retirement Gap

You have much to consider in your retirement planning.

- Rising Inflation

- Extended Life Expectancy

- Increasing Healthcare Cost

- Uncertainty of Social Security Income

To help reduce any uncertainty in your plans, it's a good idea to explore the difference in your projected retirement income and your retirement expenses. This difference represents the gap you may have in your retirement plans.

-

Plan To Win Videos 1

Video - new tab -

Plan To Win Videos 2

Video - new tab -

Plan To Win Videos 3

Video - new tab -

The 401k Fallout

By 60 Minutes

By 60 Minutes

1637 E. Valley Pkwy #282 Escondido, CA 92027 USA

Blog: Facebook Page

CA Life & Health License: 0H44285, Download

NV Life & Health License: 3112829, View

Calendar: Schedule a call

Email: richard(at)gritfes.com

richardgo@exertusmail.com

Phone: +1 (775) 583-RICH [7424]

Website: www.GritFES.com

www.GoFinancialSD.com

How Money Works Challenge

About FSCP

Exertus San Diego, CA Agent

Zoom: Passcode "92027"